Economic Empowerment Strategies for Women

Responding to Financial Abuse: Learning Financial Fundamentals

Module Two: Learning Financial Fundamentals

This module outlines fundamental financial information you’ll need if you have recently left, or decide to leave, an abuser. It will help you review your income, debt and other finance options.

Please note that the information in this curriculum is intended to be general advice for individuals involved in an abusive relationship. However, not everyone’s situation is the same. So, if you need specific advice regarding your particular situation, you should contact a victim services worker, financial adviser or attorney.

The objectives of this module are:

- Explain the basic concepts related to finance management.

- Identify sources of income and uncover your assets.

- Recall how to manage your debt and determine your liabilities.

- Explain the various banking options available to you.

Finance Management

If you are like most people, you have a limited amount of money to buy what you need and want, so you must make careful decisions about how to use your money most effectively. Limited money could mean $25 a week for one survivor, but $500 to another as everyone’s situation is different. Regardless of your personal finances, the first step to finance management is to become knowledgeable and be prepared.

Become Informed

Knowledge is the key to overcoming fear and achieving economic success. Talk to friends and co-workers who you trust and ask them for advice on financial planning. Watch money-management television programs and read about personal finances. Schedule time to attend financial workshops offered by community organizations.

Worst-Case Scenarios

Ask yourself “What’s the worst thing that can happen to me in my situation?” Is the worst-case financial scenario something you can handle? By being aware of the worst-case scenario, you can eliminate the fear that prevents you from moving forward.

Take Action

Once you’ve gathered sufficient data and information, be decisive and take action. Set small and attainable goals and begin to implement them, even if you are still learning.

Another way to help you better manage your finances is to determine the difference between a want and a need. A “need” is something you must have in order to survive and live. Needs are the essentials, the “must haves” of life like food and shelter. If you have children and are in school or employed, childcare is a need. Since needs are essential, you must pay those expenses first.

Some things, however, are “wants.” Wants are not essential, but make life easier or more fun. You may want to buy a candy bar, rent a video, eat at your favourite restaurant or buy a new pair of shoes. It’s good to treat yourself once in awhile, but learn to recognize the difference between “wants” and “needs.” By prioritizing these items, you can better plan your expenses.

In addition, find out what community resources and financial options are available to help you make more informed decisions. Victim Service workers advocates can also help you get control of your finances.

Private and public resources may provide free or low-cost services to support you and your children. They may also offer benefits to help pay for basic day-to-day needs, including housing, food and clothing. Visit http://www.pssg.gov.bc.ca/victimservices/ to learn more about your victim services in BC.

VICTIM SERVICE WORKERS

To speak to a Victim Service worker call VictimLink BC 1 800-563-0808.

Victim Service Workers are employed by more than 160 victim service programs across B.C. that are based in community agencies or police detachments and departments. Community-based programs provide services primarily to victims of family and sexual violence. Police-based programs provide services to victims of all crime types. Victim Service Workers in both types of programs have received formal training to provide assistance to victims and can provide information about the justice system, practical help, emotional support and referrals to other appropriate programs.

If you are a victim of crime, a Victim Service Worker can assist you. A Victim Service Workers provide services such as the following:

- emotional support

- help to deal with the aftermath of a serious crime

- practical assistance, such as going with you to talk to the police

- liaison with Crown counsel

- information about the criminal justice system and the court process

- accompaniment if you go to court, and assistance with preparing for court

- help to prepare a Victim Impact Statement

- notification on the status of your court case

- to both victims and those protected by civil restraining orders, notification of the provincial custody status of the offender

- information and assistance regarding peace bonds or restraining orders and having it registered in the Protection Order Registry so police have 24-hour access to the content and status of your order which is important to being able to take immediate enforcement action.

- assistance with applications for financial assistance / benefits, if eligible

- referrals to appropriate agencies and services

There is no cost for these services.

If you are unsure whether or not you want to report to the police, contact VictimLink BC 1 800-563-0808 to discuss your options.

Violence against Women Programs and Outreach

Stopping the Violence Counsellors and Children Who Witness Abuse Counsellors are employed by more than 180 programs across B.C. and are trained to provide counselling to women fleeing violence in their relationships and children who witness abuse.

Outreach Services Workers and Multicultural Outreach Services Workers are employed by more than 60 programs across B.C. and are trained to identify and connect women in crisis with the supports they need. Contact information for each program is available from VictimLink BC. For more information on the counselling and outreach programs, read the topics below.

Stopping the Violence Counselling Program

There are more than 90 Stopping the Violence Counselling Programs across B.C. that provide counselling for women who have experienced violence in relationships, childhood abuse, or sexual assault, to help them deal with the trauma of the experience.

Children who Witness Abuse Counselling Program

There are over 80 Children Who Witness Abuse Counselling Programs in B.C. that provide individual and group counselling to children aged 3 to 18 years of age who witness violence against a parent. The program is designed to help break the intergenerational cycle of violence against women by helping children cope with and heal from the trauma of living in a violent situation and learn about healthy relationships.

Outreach Services Program

There are more than 50 Outreach Services Programs in B.C. that respond to the needs of women and their dependent children who have experienced, or are at risk of violence. These programs deliver services which include supportive counselling for women, referrals to community services, local transportation, accompaniment and advocacy.

Multicultural Outreach Services Program

There are a dozen Multicultural Outreach Services Programs in B.C. that support women and their dependent children from diverse cultures who have experienced, or are at risk of violence. The program services include supportive counselling for women, referrals to appropriate community services, local transportation, accompaniment and advocacy. These services are provided in up to 24 languages to ensure women are assisted by people who speak their own language and are familiar with their culture.

PERSONAL SAFETY AND HOUSING

There are a range of services available to help ensure the safety of victims. These include housing for victims and victim notification. For more information, read the topics below.

Transition Houses

Transition houses provide temporary, supported safe shelter for women and their children who are fleeing abuse. Shelter includes food, housing, crisis intervention, information and referrals to other services. Transition houses are located across the province.

Safe Homes

Safe homes provide short-term, temporary emergency shelter and are usually found in communities where transition houses do not exist. The safe home may be a private home, hotel unit or rental apartment where a woman may stay while she’s assisted to access longer term supports.

Victim Notification and Protection Order Registry

Victims who want to be notified about changes in the status of accused or offender can register for notification with the Victim Safety Unit. If you have a civil or criminal protection order, you can have it registered to allow police 24-hour access to its conditions.

Identifying Income and Assets

A first step in financial management is to begin identifying your income and assets. This includes your own joint assets and your partner’s assets.

Consider the following:

- Are your property and financial assets held in both of your names or is everything in your partner’s name?

- Is your apartment lease in both your names? Is your home titled to both of you jointly?

- Do you have joint bank accounts?

- Has your partner threatened to make you cash-in any property or financial assets you own, so that he can share the proceeds?

- Does your partner have more than one pension or retirement plan from current and previous jobs?

- Do you know what information is required in the court order, decree or property settlement before your partner’s pension plan will pay benefits directly to you?

- The answers to these questions will be useful if you pursue child support, need to divide property or if you are going through a divorce. Remember to share this information with your advocate and attorney.

- If you suspect that your partner may attempt to hide assets, it’s important to start investigating your finances before you initiate divorce proceedings. If you have the resources, investigate the following:

- Does your partner own antiques, tools, artwork or collections whose value could be underestimated?

- Does your partner receive income that has not been reported on tax returns or financial statements?

- Is your partner the co-owner of a custodial account with your children or in your children’s names?

- Does your partner own any certificates of deposit, municipal bonds or

- Series EE Savings Bonds that aren’t registered with the IRS?

- Could your partner have asked his employer to delay any bonuses, stock options or raises?

- Has your partner recently paid any “debts” to a friend or family member that you think may be phony?

- Could your partner have retirement accounts you’re unaware of?

- Does your partner own a business?

Sorting through a financial relationship you shared with an abusive partner can be difficult, challenging and sometimes dangerous. Remember, creditors, credit counsellors, financial planners, attorneys, certified public accountants or forensic accountants can assist.

Following separation and during a divorce process, abusive partners often refuse to cooperate or make attempts to manipulate the process. Be aware of your safety risks as you manage these challenges.You may discover that your partner has:

- Opened accounts and created additional debt in your name;

- Hidden or undervalued his own assets;

- Refused to comply with payment plans established by creditors; or

- Quit his job or obtained a low-paying job to escape financial responsibility.

You may be asked to use a mediator to resolve financial obligations you shared with your partner. Mediation may not be safe, helpful or comfortable for survivors of violence sinceit requires that the parties work together as equals to reach a settlement during numerous meetings.

Managing Debt and Liabilities

In addition to income and assets, you also have debt and liabilities. If you have significant debt from credit cards or other loans, you will need to work on reducing and paying off your debt. Begin by reviewing the number of credit cards you use, the interest rate for each card, and the amount you pay annually for fees. Do the same with any loans. This process may feel overwhelming at first, but understanding where you stand financially is an important step in building your financial independence.

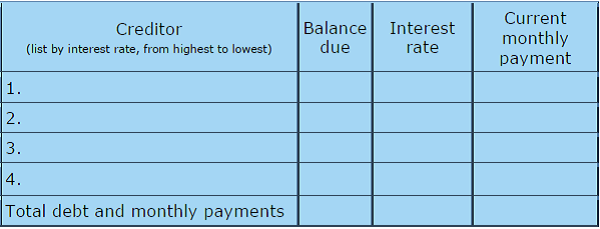

Make a list of your outstanding debts.

Figure out how much you owe. Include educational loans, home improvement loans, checking-account overdrafts, personal loans, rent-to own agreements and other instalment purchases. Use the chart that follows to document your debt. List the name of the creditor (e.g., TD Bank), the amount you owe, the interest rate and monthly payment.

Prioritize and decide which debts to pay first.

Sort your list by interest rate, putting the account with the highest interest rate at the top. Start paying more than the monthly payment for debts at the top of the list, which have the highest rate of interest, and then move down the list. If you have several accounts with smaller balances, you may want to pay off bills with the lowest balance due. While this may not make the most financial sense, it will help in a psychological sense as you’ll begin to see immediate progress.

Find credit cards and loans with the lowest interest rate.

Lower interest rates are available for good customers, but you must request them. Ask your credit card company if they would consider lowering your rate. If not, shop around for a card with a lower rate. Switching from a card with 21 percent interest to one with 14 percent could save you $50 or more per month. If you transfer your outstanding balance from a high-rate card to a low-rate card, ask the new bank to waive the transfer fee and be sure the new low rate applies for more than a few months. Below is an example of a chart to help you manage and payoff your debt.

Banking Options

Now that you have taken some time to identify your assets and liabilities, the next step is to open up a checking account (if you don’t have one separate from your partners). Selecting financial institution that meets your needs is critical to successful money management. Consider using one financial institution for all your services, bank accounts, and credit cards to limit the number of financial institutions that have information about you. This will also help in managing your finances.

Financial institutions specialize in different services and include:

Banks

Banks are financial institutions that accept deposits and channel money into lending activities. A traditional bank issues stock and is therefore owned by its stockholders (shareholders). Banks and savings and loan institutions are for-profit entities whose interests include earning a return on their investments. Traditional banks serve customers from the general public.

Credit Unions

Credit unions are community-based financial cooperatives that offer a wide range of services. They are owned and controlled by members, who are also shareholders. Credit unions serve their members, who must be within the credit union’s field of membership, as defined by its’ charter.

Payday Lenders

Payday lenders provide small cash advances, usually $500 or less. To get a cash advance, a borrower gives the payday lender a post dated personal check or authorization for automatic withdrawal from the borrower’s bank account. Payday loans come with hefty fees. For a two-week payday advance, a borrower will pay at least $15 for every $100 borrowed. Although the loans are short-term, the loan fees are nearly equal to a 400 percent annual percentage rate (APR). While these types of loans may appear to be an easy option, expensive loan fees may push the borrower into deeper debt in the long run. Consider this option carefully.

Check Cashing Stores

Check cashing stores are small businesses that cash checks for a fee. In general, the fee is about four percent.

Choosing a Financial Institution

When you are considering which financial institution to choose, shop around and begin by consider the following points:

- Think through your needs for a branch location; do you need a branch close to your home or work?

- Compare services.

- Compare how comfortable you feel with the staff.

- Does the bank meet cultural needs and requirements?

Generally speaking, a large national or international financial corporation will offer a wider range of services, but may provide less personalized service than a smaller institution. Instead of a bank, you may wish to consider a credit union.

In your personal situation, consider if culturally-specific services are required. Look for banks that have multi-lingual employees or Web sites and information in other languages. Some institutions are specifically owned by, and run for, specific ethnic, religious and cultural clientele. For instance, are you interested in wiring money to family in another country? Does the bank offer this and what are the fees?

In order to compare banks, consider the services they offer and discover the fees that are charged for these services:

- Checking accounts: fees, minimum balance requirements and

- overdraft charges

- Automated Teller Machines (ATMs): availability and fees

- Savings accounts and products: interest rates, restrictions and

- penalties on withdrawal

- Bank branch hours: are they convenient for your work schedule

- Telephone services: available 24 hours, automated or immediate

- connection to a consultant

- Online banking and bill pay

Using an ATM

Banking used to be mostly done by using a bank teller, however today banking is often done electronically. Banking transactions done by an ATM include depositing money, withdrawing money (getting cash), or checking your balance from either your savings or checking accounts. The benefits of using an ATM include easy access to banking services and easy access to cash. This reduces the need to carry large amounts of cash.

To use an ATM, you will need a bank account, and you will also need an ATM card. With this card you will get a code, also known as a Personal Identification Number (PIN).

To begin using an ATM, you will first place your card into the machine and enter your PIN. Then you will be able to do your banking. When entering your PIN, be sure no one is looking over your shoulder, and position yourself to block anyone from seeing your PIN code. Keep your PIN number a secret, and do not disclose it to anyone (especially your abuser). Do not write your PIN number on your ATM card, keep your PIN on a piece of paper in the same location as your ATM card, or keep this number in your wallet. For added security, change your PIN number periodically. If your ATM card is ever lost or stolen, report it immediately to your bank.

If you are going to do a deposit, try to have all the necessary paperwork ready. In fact, try to keep some deposit envelopes with you so that way you minimize the time spent at the ATM. Also, make sure the ATM location is well lit. Do not approach or use the ATM if the area looks unsafe. Look for suspicious people around the ATM. Use a machine that is visible to nearby traffic. If possible, bring a friend along to stand nearby when using an ATM. Lastly, avoid talking to strangers when using the ATM. When your transaction is complete, be sure to take your money and place it immediately in your wallet or purse. Also, don’t forget to take your ATM card before leaving. Do not stand around and count your money at the ATM. If there is a discrepancy between the amount withdrawn, and the cash received, then notify your bank immediately (be sure to identify the machine that you used).

Lastly, be sure you are aware of the banking fees for using an ATM, as fees will vary by bank and machine. Using an ATM owned by your bank will often result in lower (or no) fees compared to using an ATM from another bank, however each bank sets their own fees. Be especially careful if you only make small (for example twenty-dollar) withdrawals. If the fee per withdrawal is $1.50, then you will be paying a lot of unnecessary fees. In this case, it is better to make a single withdrawal of $100, then multiple withdrawals of $20. Try to use a bank account that does not charge you for using their machines, and try to stick to using your own bank’s ATM machine.

By identifying your income, assets, debts and liabilities, and opening an individual bank account (separate from your partners) with an ATM card, you will begin to better manage your finances. Continue to read through this curriculum to learn more about money-saving strategies and budgeting techniques.

NEXT > MODULE THREE: Budgeting, Saving Investment and Education

BWSS’ Economic Empowerment Strategies for Women is funded by: