Economic Empowerment Strategies for Women

Responding to Financial Abuse: Budgeting, Saving, Investments and Education

Module Three: Budgeting, Saving, Investments and Education

What is a Budget?

A budget is a spending plan, a tool to put you in control of your money. It shows how much money you have, where it needs to go to meet your needs and wants and when you will be able to reach your financial goals.

For women survivors of abuse, learning how to budget finances independently is an important step towards preparing for a stable future.

This module provides steps you can take to manage your budget, set proper financial goals and save money, as well as other advanced money-saving topics such as investing and education planning.

Please note that the information provided here is intended to be general advice for women involved in an abusive relationship. However, not everyone’s situation is the same. So, if you need specific advice regarding your particular situation, you should contact a financial counsellor, credit adviser or an advocate. Please check the Resource section of this booklet for a list of resources in BC.

The objectives of this module are:

- Explain the basics of money management

- Help you identify and set proper and achievable financial goals

- Provide strategies that will help you save money short- and long-term.

- Describe the various options to invest your money.

- Overview of Insurance Options

Budgeting Basics

A budget is a tool that will help you make important spending decisions. If you’re considering ending a financial relationship with your partner, it’s important to review all of your assets to find out if they will support you and your family. When you end a relationship, your income and financial assets may change dramatically. If you take time to determine how much money you need to support your family before you leave, you can prepare in advance to meet your family’s financial needs.

If you don’t have enough money to support your family, or if you have substantial debt, don’t despair! Debt is common and there are many resources to help you manage it.

- List the assets you currently have such as housing, car, and bank account, etc.

- Review all your financial liabilities, . Do you have credit-card debt or do you owe money to family or friends? By understanding how much debt you have, you can better manage your finances.

Whether you’re living with your partner and have never married or are seeking separation or divorce, you may be able to get help resolving your debt, accessing insurance and obtaining other financial support in hopes for financial security.

The definition of financial security varies from person to person. For some, it means having food, shelter and a decent job. For others, it means being able to live where they want, afford childcare and own a car. And for others, financial security is defined by preparing for a comfortable retirement, enjoying vacations, owning a home, and paying for education and training.

Financial security is one of the many reasons why making the decision to end an abusive relationship can be difficult. Most women find that their standard of living declines after ending an abusive relationship and those without employment may have to work to support themselves and their children. This can be overwhelming and frightening.

Regardless of how you define financial security, if you are planning to or have made the decision to leave an abusive partner, having the skills to manage your finances is crucial.

To create a budget, follow these steps:

Step 1: Identify your net monthly income

Calculate how much money you receive each month. This is the money that comes into your household, after deducting taxes, pension dues, insurance, etc. Consider all sources of income.

Step 2: Identify your monthly expenses

Monthly expenses include rent and utilities, as well as those that occur periodically, like car insurance and medical expenses. Don’t overlook any expenses; not all your expenses are paid monthly.

Step 3: Subtract your monthly expenses from your income

The difference between your income and expenses indicates whether or not you have any money to spare. If you have extra money, you’ll need to decide whether to spend or save it. Can you reduce expenses or earn more money to cover shortages? By distinguishing between needs and wants, you can better identify areas where you might be overspending.

To continue the budgeting process, complete the form on the next step.

Step 4: Assess and rework your budget

At the end of each month, look over your expenditure to see if they are matching up to your budget. If they are not, determine if you need to work harder to stick to your plan, or if you need to rework your budget to reflect your actual spending.

While identifying your monthly expenses you may realize that there seems to be more money going out than is recorded. That is because every family has spending “leakage” – little expenses that are not accounted for but add up.

TIP: Recording your expenses for two or three month will give you a better estimate of monthly expenses. This is not easy, and there will times when you forget. But knowing how much you need to cover all your expenses is an important step towards your financial safety and independence.

Personal Budget Form

Use the form below to calculate your budget or click here to download a version of this form that you can print.

Living on an income that changes

When your income changes from month to month, financial planning becomes a bit more challenging. To figure out how much you should count on each month, you could use the following methods of budgeting:

1: Create Two Budgets

Create a budget that covers your basic needs based on your lowest monthly income. Create a second budget that includes these basic needs plus other monthly and annual expenses such as gifts, entertainments, etc. Use the income that you get in a higher earning month to cover some of these expenses. For example, you could buy an annual pass at a recreation facility during your high earning period so that you can have a chance for recreation during other times.

2: Use Regular income for Regular Expenses

Another way to do budgeting while living on an irregular income is to split your income into categories: fixed expenses that must get paid each month, and yearly expenses that vary. Use your regular income to pay fixed expenses and use your fluctuating income for the others.

Let’s say, for example that my monthly income sometimes is $1000 and on some month I get $800. The minimum income, which is $800, is the one that you have to use to pay your fixed expenses with. On the month that you have 1000, you have your regular income, $800 plus an extra $200. This extra money is your fluctuating income. On the month that you earn 1000, you could pay the fixed expenses with 800 of that money and use the 200 to pay for the annual recreation pass, gifts or such.

Saving

Saving should be part of your budget. It is important to put aside some money each month for savings, if possible.

Start by deciding how much you could realistically save each month. Once you determine that amount, pay yourself first. Before you pay bills, set aside money for your savings. Then pay your other bills. If you do not have enough money to cover all the expenses, find ways to reduce spending or increase your income. This may mean you have to work a few extra hours, pack lunch instead of eating out or limit treats for your children.

This may sound difficult, but you will feel good knowing you have money saved for your future. Over time, paying yourself first will get easier, and you’ll wonder why you didn’t do it sooner!

TIP: Find out the interest rate on your credit card; if possible transfer your debt to a line of credit instead. Compare to credit cards, line of credits often charge much lower interest rates.

Work with a support worker or an advocate to develop a plan to access resources in your community. A financial or credit counsellor can help you identify your financial resources and reduce debt. There are organizations that provide free credit counselling. See the resource section of this hand out for more information.

Once you have a clear picture of your liabilities (money you are responsible for paying off), you need to start creating a plan to lower and eliminate them to reach your financial goals. Your plan could be as simple as paying off the credit card debt with the most interest charge first.

Setting Financial Goals

To manage your money wisely, set financial goals and establish a budget to help you achieve them.

What are your personal financial goals? For example, if you had $1,000, what would you do with it? Buy a new fridge? Set up a savings fund for emergencies? Whatever you have identified, can likely be categorized as a financial goal; therefore, to achieve your financial goals you’ll need to manage your finances and put money aside regularly.

Financial Goals and Emotions

For many of us, emotions and money are closely tied and spending to fill an emotional need can be a challenge when sticking to a budget. If you are having trouble sticking to your budget, ask yourself the following questions:

Am I shopping to make myself feel better? What emotions am I experiencing and is there another way that I can fill this need?

These are just a couple of examples of how spending can take on an emotional element in your life and how it can pose challenges in regard to keeping a budget.

Strategies for Dealing with Emotions and Money

Being aware and planning ahead can help you overcome emotions that may cause impulse buying.

Step 1:

Write goals down and identify how much time and money it will take to get there.

Step 2:

Keep your written goals handy and remind yourself often of the priorities you have set. This may help keep you on track if your emotions start to take over.

Step 3:

Identify your feelings and consider if you are being tempted to buy things you don’t need based on emotion. If so, consider an alternative way to meeting your emotional need and remind your self of how you will feel when you are successful in meeting your goals.

As a final tip before making a purchase, research to be sure you are paying a fair price. Don’t overpay because you “fall in love” with something. And don’t spend more than you can afford. If you pay more than you can afford, it will take longer to achieve your financial goals.

If your children are old enough to understand the benefits of spending less today to reach future goals, discuss this with them. Talking about finances and getting them involved in managing money may help you reach your financial goal and benefit your children by helping them learn financial skills early on.

Teaching children how to manage money is a challenge. But if you teach them the difference between “needs” and “wants,” how to budget and how to save, they will know more than many adults. If you don’t teach these important lessons, they will be more likely to join the millions of North Americans who accumulate massive debt.

The best way to teach children about finances is to be a role model. They will pay attention to what you say about money and to how you manage money. Show restraint with money. Let your children see you budget, comparison-shop and make regular contributions to a savings account.

TIP: Treating your self and you children need not be expensive! Here are some inexpensive ways to treat yourself and your children without breaking the bank

Treat Yourself:

- Give yourself a manicure

- Enjoy your favourite dessert

- Read a good book

- Spend time with a good friend

- Go for a walk

Treat Your Children:

- Bake them a cake

- Read them a story

- Rent a video or borrow one from the library

- Play their favourite game with them

- Invite their friends for a sleepover

Savings Strategies

It is a good idea to start saving for emergencies. An emergency savings fund should have enough money to pay three to six months of living expenses such as repairs on a car or pay two month of rent, allowing you to avoid paying interest on a credit card or simply doing without. If you do not think you can ever save this amount of money, begin saving as much as you can. Every dollar helps!

It’s important to put money away consistently and tap it only for true emergencies. It’s better to save $10 every month than to save $25 only occasionally. Put money aside by making a deposit to your account as though you were paying a monthly bill.

Earning interest on your savings is important and the best way to ensure your future financial success is to start saving today. The secret to money is by saving money coupled with the miracle of compound interest.

Compound interest is interest that is paid on both the principal and also on any interest from past years. For example, lets say in the month of May you put $ 100 (the original amount you put in the account is called the principal) in a saving account that pays 2% interest; next month, in June, you will have $102 in your account (principal plus $2 which is the interest added by the bank); for the month of July, then, the bank will pay 2% interest on the $102, instead of on your principal of $100. So, in July you will have $104.4.

Even modest returns can generate real wealth given enough time and dedication.

Compounding may appear tedious and boring. “So what if my money earns 4 percent in a high-yield savings account?” you may ask: “Why is it important to start investing now?”

For example, if 20-year-old Maria makes a one-time $5,000 contribution to her retirement account and earns an average eight percent annual return, and if she never touches the money, that $5,000 will grow to $160,000 by the time she retires at age 65.

But if she waits until she’s 39 to make her single investment, that $5,000 would only grow to $40,000. Time is the primary ingredient to the magic that is compounding.

Compounding can be made more powerful through regular deposits and investments. It’s great that a single $5,000 retirement account contribution can grow to $160,000 in 45 years, but it’s even more exciting to see what happens when Maria makes saving a habit. If she contributes $5,000 annually to her retirement account for 45 years, and if she leaves the money to earn an average eight percent return, her retirement savings will total over $1.93 million. She will have more than eight times the amount she contributed.

Try not to put off saving. “I can start saving next year,” you tell yourself. “I don’t have time to open a retirement account, I’ll do it later.”

But the costs of delaying are enormous. Even one year makes a difference.

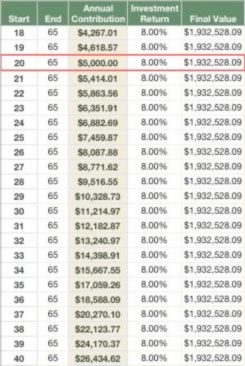

Below is a chart to illustrate the cost of procrastination.

If Maria makes $5,000 annual contributions to her retirement account, and she earns an eight percent return, she’ll have $1,932,528.09 saved at retirement. But if she waits even five years, her annual contributions would have to increase to nearly $7,500 to save that same amount by age 65. And if she were to wait until she was 40, she’d have to contribute nearly $25,000 a year!

To make compounding work for you:

Start early.

The younger you start, the more time compounding can work in your favour and the wealthier you can become. If you didn’t start early, don’t despair, there is still time. Put away as much as you possibly can. Federal regulations allow older workers to put more money into retirement plans to “catch up.”

Make regular investments.

Remain disciplined and make saving for retirement a priority. Do whatever it takes to maximize your contributions. If you work for a company that provides a match, make sure that you enrol are eligible for the highest match from the company.

Be patient.

Do not touch the money; compounding only works when you allow your investment to grow. The results will seem slow at first, but persevere. Most of the magic of compounding comes at the very end.

Savings Strategies

There are a number of types of accounts where you can earn interest on your savings. When deciding where to put your money, consider how available you need it to be and what kind of interest rate you can earn on your money. For example, emergency funds need to be readily available so a typical savings account is a good choice. However, funds that won’t be need immediately can usually earn a higher interest rate in a money market account of certificate of deposit (CD).

Here is a summary of typical types of accounts for savings:

Interest-Earning Savings Accounts

You’ll earn about two percent interest on your savings and receive a monthly statement in the mail. Funds can be withdrawn at any time.

Money Market Accounts

These pay about one-half percent higher interest than savings accounts, but may require a higher minimum balance. You can usually make as many deposits as you like for free, but you can only write three checks each month.

Certificates of Deposit

If you have money that can be tied up for three months to six years, certificates of deposit will offer the highest interest rates, depending on the term you choose. There are stiff penalties for early withdrawals, so choose a term you can live with.

Investment Options

Investing is defined by putting your money to work for you. Essentially, it’s a different way to think about how to make money. Growing up, most of us were taught that you can earn an income only by getting a job and working. And that’s exactly what most of us do. There’s one big problem: if you want more money, you have to work more hours but there is a limit to how many hours a day we can work.

You can’t create a duplicate of yourself to increase your working time, so instead you get your money to work for you. That way, while you are putting in hours working and raising your family, you can also be earning money elsewhere (even if it is in very small amounts). Quite simply, making your money work for you maximizes your earning potential whether or not you receive a raise, decide to work overtime or look for a higher-paying job.

There are many different ways you can go about making an investment.

This includes putting money into stocks, bonds, mutual funds, or real estate (among many other things), or starting your own business. Sometimes people refer to these options as “investment vehicles,” which is just another way of saying “a way to invest.” Each of these vehicles has positives and negatives. The point is that it doesn’t matter which method you choose for investing your money, the goal is always to put your money to work so it earns you an additional profit. Even though this is a simple idea, it’s the most important concept for you to understand.

The most obvious investment for many of us is for our retirement. A retirement plan is a savings strategy designed to provide employees with an income or pension after they are no longer working. Retirement plans can be set up by employers, insurance companies, the government or other institutions such as employee associations or trade unions. The following are some of the ways you can save for retirement.

Individual Retirement Accounts (IRAs) are retirement savings accounts that provide tax advantages when you save for retirement. There are different types of IRAs, some provided by employers and others are set up by individuals.

Pensions are retirement plans set up by employers to provide benefits to retired employees.

401(k) Plans are retirement plans that defer income taxes on retirement savings and any interest they may earn until withdrawn. Most plans are sponsored by private-sector corporation employers. Comparable salary deferral retirement plans include 403(b) plans that cover employees of educational institutions, churches, public hospitals and non-profit organizations and 401(a) and 457 plans that cover employees of state and local governments and certain tax-exempt entities.

Determine how much money you need to retire comfortably. When calculating the amount, remember that during retirement you’ll save money on clothing, commuting and other costs associated with earning a living.

You may also have fewer expenses related to caring for children, but your healthcare expenses may be higher.

As a general guideline, you can expect to live on 70 to 80 percent of your pre-retirement income. But this is just an estimate. Some retired women spend as little as 60 percent of their pre-retirement income, while others spend more than when they were employed.

To calculate your retirement needs, consider these questions:

How long will your retirement last?

Would you like to retire early or are you planning to work at least part-time as long as you can?

How much will a dollar be worth?

During times of inflation or rising prices, you’ll need more income to support your current lifestyle. When calculating how much money you’ll need for retirement, assume inflation rates of three to four percent.

How much will you spend?

What type of retirement do you envision? Do you plan to stay in your current home?

When considering how you will divide your funds, it’s important to consider how many years you have until you retire and how much you are willing to take risks. Contacting a personal financial representative can help you decide on the best investment strategy.

Savings Bonds

Savings bonds are issued by the government, in face value denominations from $50 to $10,000. Interest on the bonds accumulates tax-free. When you buy a savings bond, you usually pay half its value, and when it matures the bond is worth twice as much as you paid. For example, if you pay $50 for a $100 savings bond, it will be worth at least $100 upon maturity.

Mutual Funds

Mutual funds are a collection of stocks from different companies that are combined (or co-mingled) to provide a single investment. For example, a mutual fund might invest 10 percent in bank stocks, 25 percent in retail outlet stocks, 25 percent in medical technology stocks, 25 percent in high-tech stocks and the remaining 15 percent in government securities. Mutual funds accept money from many investors and often charge a fee to manage the “mix” of stocks.

Stock Investments

Stock investments make you a shareholder of a public company and indirectly allocate your money to be used in the company’s business. In return for your investment, you are entitled to a share of the company’s profits. Earnings are paid back as dividends or retained to help the company grow. If the company isn’t profitable, you may experience losses.

Bonds

Bonds correspond to a loan to a company. A bond is a contract that guarantees your loan will be repaid by a specific date (maturity date) and that you will receive a specific interest rate for the use of your money.

Bonds are a relatively safe way to invest and most pay interest semi-annually.

They pay the face amount when they reach maturity. The last area to address in regard to investment options, and one that is less common, is estate planning. An estate plan will preserve your assets after you die. Although you may not consider yourself wealthy enough to have an “estate,” if you own a home, furniture, car or have money in a retirement fund, you need to protect it no matter how old you are.

An estate plan can protect your assets and provide financial and emotional stability for your survivors. If you die without an estate plan, legal problems may delay the distribution of your assets. There are several ways to protect your estate that are outlined below.

Establish a will.

This is usually the heart of an estate plan. Without a will, the laws of your state will determine who receives your property. If you don’t designate a legal guardian for any dependents or minor children, a court will decide who will raise them.

Establish a trust.

This can hold virtually any kind of tangible or intangible property and can be as flexible as needed to meet your objectives. Some trusts are established to avoid probate or reduce future estate taxes. Others are designed to provide for minor children.

Designate powers of attorney.

This document clearly states your wishes about how to handle your healthcare and property and who is responsible for carrying them out if you are unable to communicate. Be sure to pick somebody who as consistently been a part of your life and likely always will.

Purchase life insurance.

Life insurance can provide the cash your survivors may need to pay federal estate taxes when you die. If you purchased life insurance prior to leaving your abuser, remember to change the beneficiary names.

In addition to these common investment options, most communities offer a variety of asset-building programs to help you reach your financial goals.

Contact community organizations to find out if they offer any of the following programs and whether there are income limits:

Individual Development Accounts (IDAs )are savings accounts matched by public and private sources for investments in education, homes and businesses. The accounts match your savings and allow a set period to save for specific goals. These goals usually include education, home purchase or seed money to start a business.

Micro-Enterprise Development are small capital investments that allow individuals to form micro-businesses to contribute to their family’s economic and social well-being.

Financial Literacy Programs help families learn how to manage their finances and make wise economic choices. These programs help families move toward goals, including owning a home or business, or saving for education and retirement.

Insurance Overview

Insurance is an important part of your financial well being. It can help protect you financially if you have health problems, are involved in a car accident, or if your home is damaged or destroyed.

Extended Health and Medical Insurance covers health and medical expenses not covered by HealthCare. Such insurance may cover some or all of the expenses of dental care, eye exams, drugs and medicines, etc.

Auto Insurance can help you repair or replace your car if you get into an accident and help protect you in the event of a lawsuit. In most states, you are required to have some level auto insurance if you have a car. Drivers must be able to pay for any losses they cause, including the cost of repairing a damaged car, paying for medical expenses and more. The minimum level of insurance you should carry is typically what is called ‘liability insurance.’

Home Insurance pays to repair and replace your home if it is damaged or destroyed. Renters need insurance to protect their furniture and other personal property, as well.

Life Insurance can help provide your family with a stable financial future.

It can help cover funeral expenses, childcare and other costs.

Disability Insurance provides a portion of income lost due to a total or partial disability caused by illness or accident.

In addition to insurance you may purchase on your own, when applying for a job ask the potential employer about employee benefits that may include short- or long-term disability or life insurance.

Educational Opportunities

This topic of the module includes strategies for continuing your education.

There are several ways to develop advanced skills, pursue higher education earn an advanced trade or obtain a professional license. By completing a GED, undergraduate or advanced degree, certificate or on-the-job training, you are more likely to get a better job and advance in your career. In fact, people with more education generally earn higher salaries.

Note: The General Educational Development or GED credential is an international document accepted by many employers and postsecondary institutions.

Links to information regarding the GED testing service in British Columbia:

Many women who have experienced abuse feel a strong desire to “give back” once they have left their abuse and seek new careers in social services to do so. This is great if it meets your financial goals and your interests and abilities. However, remember that the most important consideration is taking care of yourself and your family first. There are many ways to “give back” which may include establishing yourself in a better paying job and making contributions to women organizations or engaging in volunteer activities.

A career counsellor can be very helpful in assisting you in developing or changing a career path. Many community colleges and universities offer career counselling to students and women seeking to change careers.

Below is a brief list of various education and training options available:

B.C. Adult Graduation Diploma (Adult Dogwood)

There are a number of ways that adult learners can complete their graduation requirements. Adult learners have the flexibility of working towards a B.C. Adult Graduation Diploma (Adult Dogwood) or a regular B.C. Dogwood Diploma. They may also choose to take the courses they require through B.C. school districts and/or B.C. post-secondary colleges/universities (ABE – Adult Basic Education Programs).

The B.C. Adult Graduation Diploma (Adult Dogwood) student must be 19 years or older to gain entry to the Adult Graduation Program; 18-year-olds may qualify if they have been out of school for at least one continuous year prior to enrolling and they have permission from the school administrator. Credit for at least three of the courses needed to meet Adult Graduation Program requirements must be acquired as an adult.

General Educational Development (GED)

GED program is a way to obtain a high school diploma. Most businesses, colleges and technical schools recognize the GED as the equivalent of a high school diploma.

Apprenticeship Process in BC

Apprenticeship is a type of learning or internship for a trade that consists of on-the job training combined with post-secondary trades training. An apprentice spends 80% to 90% learning on the job and 10% to 20% learning in a trade’s classroom and/or shop environment. There are two routes an apprentice can take to receive a trade’s qualification in BC or an inter-provincial trade’s certificate which is recognized across Canada. A person interested in pursuing a trade can prepare for an apprenticeship by taking an ELTT (Entry Level Trades Training) Program at a recognized training institution. An alternate method is to find an employer (in the trade you are interested in) who is willing to hire you and consider offering you an apprenticeship with their company.

Community Colleges provide associate degrees and the opportunity to transfer to a four-year college or university. Community colleges are often less expensive than four-year colleges and universities.

Trade or Vocational Schools provide specialized training in specific fields, including nurse’s aide, plumbing technician, heat, ventilation and air conditioning technician, truck driver, cosmetologist, and more. A trade school may be appropriate if you know what you want to do and prefer hands-on learning.

Certification Programs provide sufficient training to work in a specific profession. Some certificate programs are administered by the state, while others are offered by colleges, universities or professional schools.

Many certification programs require a college degree in addition to a standardized exam. Some certifications must be renewed regularly, requiring continuing education courses.

Online Education is an alternative to trade schools, community colleges and four-year colleges and universities. Most online education programs allow you to work at your convenience, anywhere you can access a computer. Online education programs are especially appropriate for women with transportation problems or who are trying to balance family, work and education.

Four-Year Colleges and Universities grant undergraduate (bachelor’s), graduate (master’s and doctoral) degrees and professional certificates.

Another factor to consider when looking at continuing your education is how you are going to pay for learning. The following tax-free or tax-deferred investments can increase your returns without raising your level of risk.

Financial Aid including scholarships and grants is “free money” provided by the federal or provincial government, private organizations or the school. You do not have to pay it back. Scholarships are often awarded without consideration of financial need to students who have demonstrated excellence in specific areas or disciplines. One website to visit to learn more about possible scholarships is www.scholarshipscanada.com/

On-campus student jobs and work-study programs, which are government subsidized and need based, allow students to earn money for their education.

BWSS’ Economic Empowerment Strategies for Women is funded by: